< Back

A fresh approach to integrations

13/06/24 · By Joseph Williams

Last month, 94% of financial advisers told intelliflo that a lack of integration is the major reason why their advice journey isn’t as efficient as they would like. And only last week, that point was reiterated at intelliflo’s innovate conference. Nick Eatock, CEO of intelliflo, highlighted during his on stage strategic update that “fragmentation of technology, rekeying, and systems not integrating has been frustrating for you.”

But this research and the need for greater integration has been ever present for many years. In 2019, 85% of financial advisers told both the lang cat and Origo that a lack of integration between technology is the major cause of inefficiency within their business. Fast forward to today and FE fundinfo’s Annual Adviser Survey indicates that 90% of financial advisers consider integration between technology to be important.

It's safe to assume that most within our profession are pro-integration and regard it as one of their top priorities. However, it’s also fair to argue that despite best intentions, little progress has been made. We seem to be in a stagnant situation whereby lots of APIs have been developed, but few integrations have actually been built (at least at a rate which has research figures fall instead of rise).

There are numerous reasons why an integration may not be built. These can vary from an unwillingness to allow data to flow outwards in fear of losing users, to technology providers fairly focusing on making their core product best of breed. Regardless, technology providers should have faith in their core product to retain users, whilst also investing in integrations to ensure they become or remain competitive.

This latter point is especially true for new technology trying to enter the market and gain market share. Unless they turn attention away from developing their core product and invest time building individual integrations with other technology providers, it’s unlikely they’ll ever gain a strong enough foothold. And the fragmentation of technology within our profession will only worsen.

In a roundabout sense, it’s a great position to be in. More innovation means greater choice. A focus on developing the core product produces greater functionality. But not integrating technology only adds to the fragmentation. This element cannot be ignored, and it's time our profession (or more specifically, technology providers) work together to solve this growing pain point.

There needs to be a commitment to openly integrate technology, to allow data to move freely from one technology provider to another, and to enable financial advisers the freedom to choose whatever technology they like without restriction or compromise – financial advisers shouldn’t have to sacrifice efficiency because the technology they consider best of breed isn’t integrated.

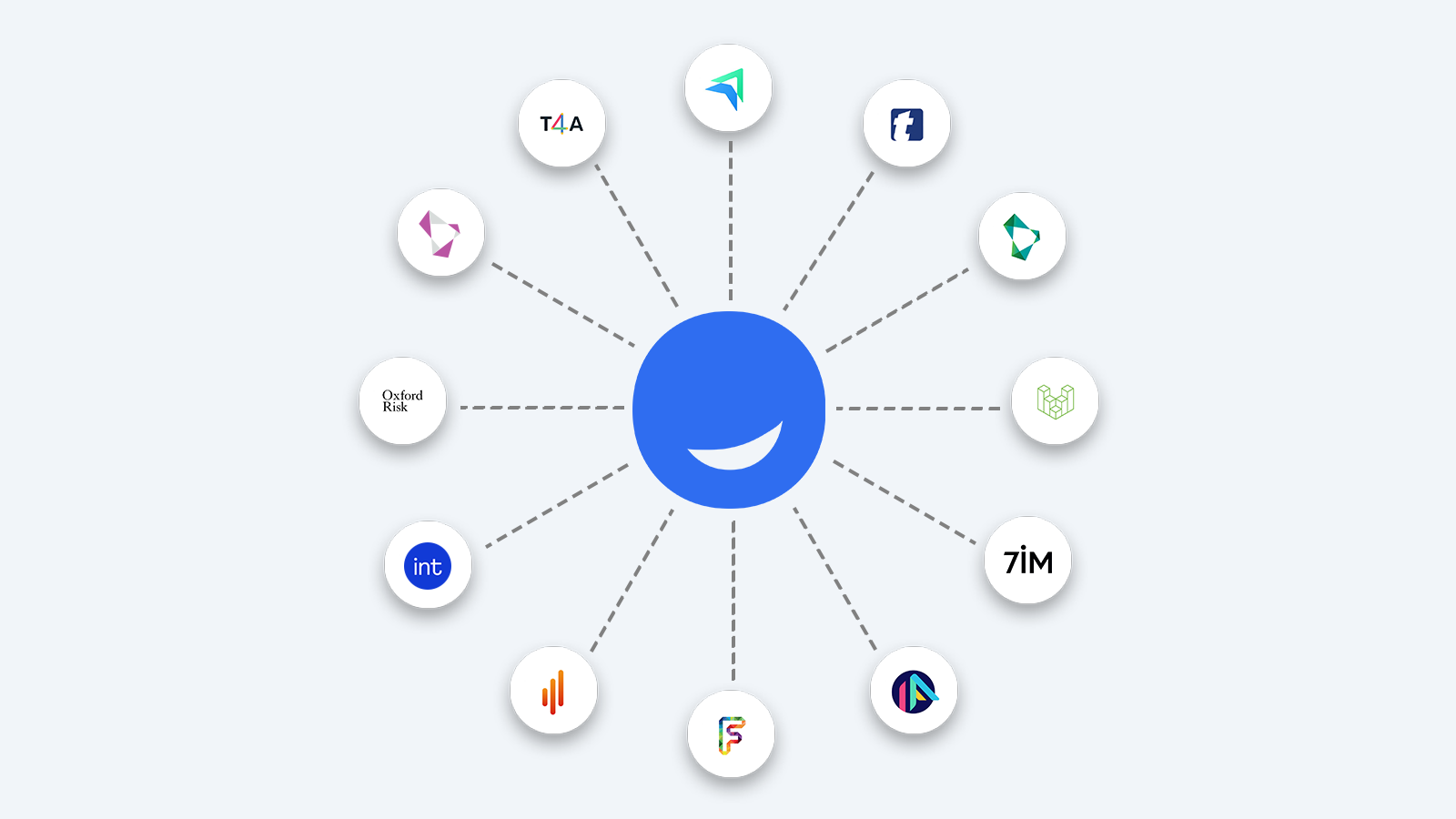

The purpose of ZeroKey is to therefore accelerate this agenda. Our mission is to integrate technology and eliminate manual data entry – it is our sole focus. We want to work with technology providers whether an API is available or not, and act as the conduit that will allow financial advisers to easily move data from technology A to technology B with ease.

It's important to note that we do not store any client data. We are not a data hub or aggregator. Instead, we simply allow financial advisers to integrate the technology they use, and provide the ability to pull data in from a source (e.g. intelliflo) and push it into a destination (e.g. Transact). This functionality is not simply limited to technology specifically made for financial advisers either – it could also cross professions.

So in summary, we can either continue down the integration path we have always trodden, or we can forge a fresh one that runs alongside the traditional approach. One which is agnostic, that builds integrations for the benefit of all, and that enables technology providers to focus on developing their core product. We simply need technology providers to remain true to their word and support an integrated profession.

Related stories:

Move client data anywhere, anytime

An update on our progress so far

Press release: ZeroKey to build web-extension to eliminate manual data entry

Press release: Former CashCalc employees reunite to solve the integration issue